Ah, tax season. This may be a newer topic for some, or may be a well known hassle for others: however, it doesn’t have to be so unfamiliar.

Starting Jan 29, most U.S. citizens and permanent residents are required by the IRS to file their federal and state taxes no later than April 15. Commonly referred to as a tax return, this document displays your earned income and contribution in taxes from the previous year: most oftenly resulting in a refund of some dollar amount due to overtaxation.

Typically, employees will receive a W-2 document from their employer which reports wages paid and taxes taken out from that receiving employee. This document is necessary when filing taxes and results in an annual 1040, aka your tax return.

Another form of documentation that may be required for filing taxes is 1098-T’s. This specifically applies to higher education students as it presents how much the student paid in tuition, as well as scholarships or grants received.

This form comes especially in handy as students may be eligible to receive tax credits up to $2000-$2500 through The American Opportunity Credit or The Lifetime Learning Credit which refunds the students’ spending of supplies, equipment, tuition fees, etc.

Now, to the actual task of filing taxes (online).

An arguably well known entry-level avenue is TurboTax, offering the ability for students to file simple returns like W-2’s and options to speak with experts for free. However, if an individual has more complicated forms, like an 1099-NEC (non-employee compensation that is typically associated with sole-proprietorships, freelancers, etc.) to be filed, that does require additional fees. The website also has options for paid assisted or full service tax-filing if preferred.

H&R Block is another online company that has a $0 fee for filing your own taxes but with simple only. They have relatively lower fees overall compared to TurboTax. Otherwise, there are additional fees to have professionals and tax pros help with options to have assisted or full service filing. H&R Block also has on-site locations if some prefer to physically drop off forms or have in-person aid.

H&R Block is another online company that has a $0 fee for filing your own taxes but with simple only. They have relatively lower fees overall compared to TurboTax. Otherwise, there are additional fees to have professionals and tax pros help with options to have assisted or full service filing. H&R Block also has on-site locations if some prefer to physically drop off forms or have in-person aid.

FreeTaxUSA is, as the name implies, free for all federal tax returns; no matter the complexity. However, it is less entry-level friendly as it requires the customer to manually enter large amounts of information versus its software spiffy TurboTax and H&R Block counterparts. The website also has a $15 fee for state returns and additional options for online tax service with specialists in assisted filing.

Another resource to mention is Cash App. Yep. They do tax returns, as well. They provide users with one federal and state tax return completely for free with the promise of maximum tax refunds. The company does not have many file importing options, resulting in more manual input of information and the recommendation to utilize this resource with more simple returns. Navigating the website may be a little confusing at first and requires a much more independent tax-filer as it has a lack of professional support.

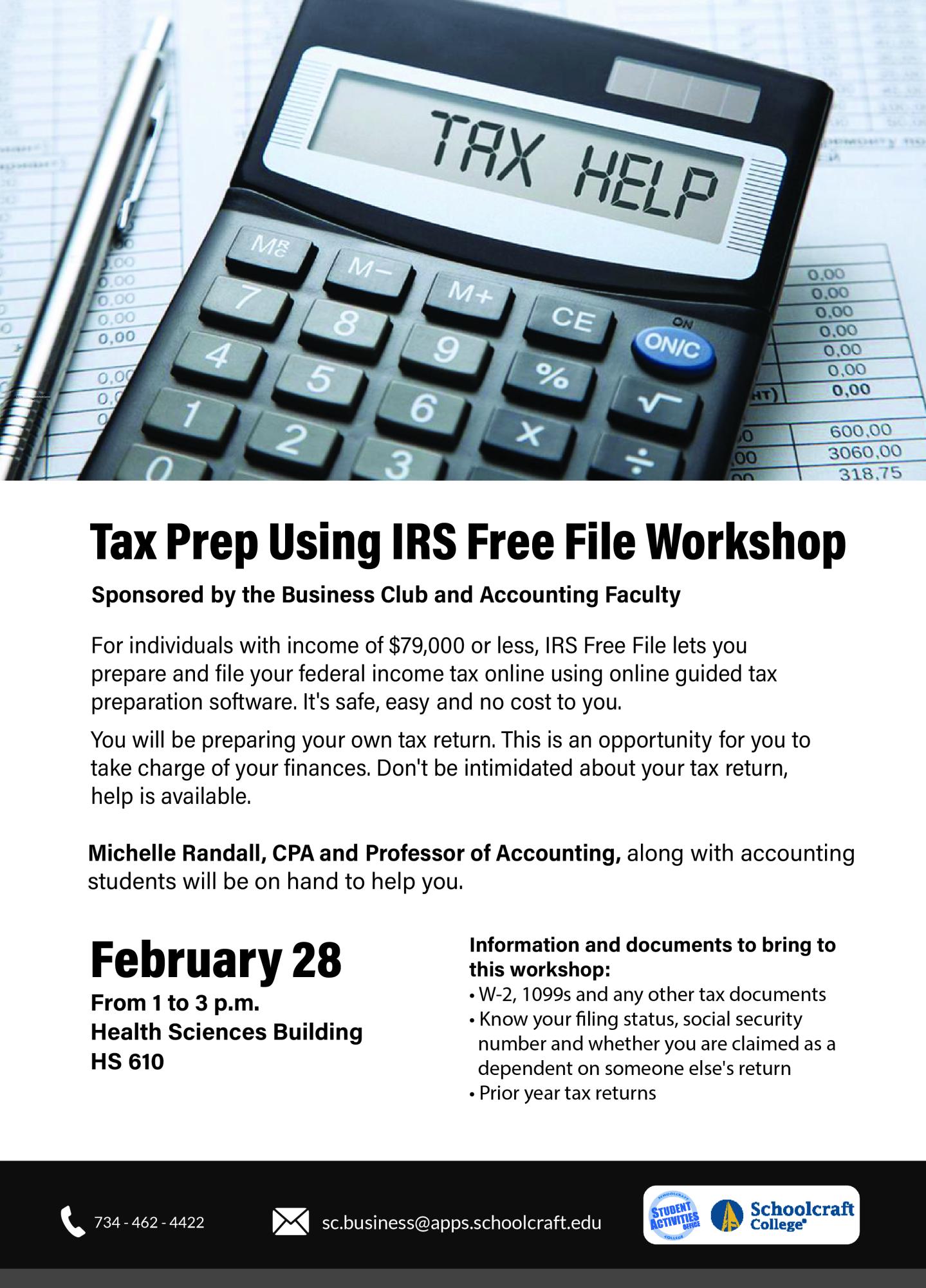

The Schoolcraft Business Club and The Accounting Faculty will be hosting the Tax Prep using IRS Free File Workshop on Feb. 28 from 1-3 p.m in Health Sciences Building, HS610. This offers assisted filing with Professor Michelle Randall through IRS Free Filing with the intention of being cost effective for students.

With numerous outlets of information it can become daunting and overwhelming very quickly. Hopefully with the assisted help sourced from the options above and some newfound information boosts your confidence to file your taxes.

Go get that money!

For more information on The American Opportunity Credit and The Lifetime Learning Credits, as well as additional student-specific aid visit https://www.irs.gov/publications/p970#en_US_2017_publink100077522.