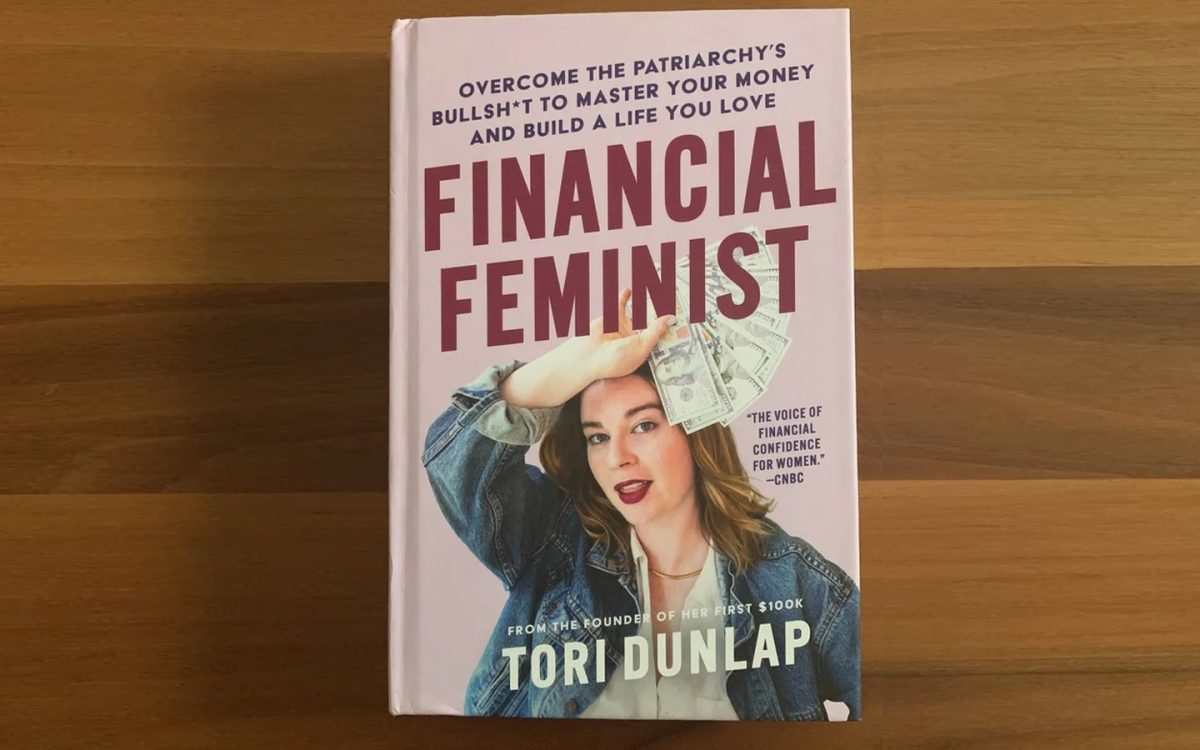

“Financial Feminist”

Author: Tori Dunlap

Publishing date: Dec. 27, 2022

Available on: Kindle, Audible, paperback, Libby, and Hoopla

Category: Self-help, Adult

Trigger warning: Use of profanity and references of SA

What does money mean?

It can mean power, social status and for many it simply means stability. The topic of money can feel taboo or even shameful to be talked about amongst co-workers and friends. Some may feel embarrassed because they are inept in money conversations, or feel that the desire for more is selfish; this can be true with women. “Financial Feminist” by Tori Dunlap explores and offers advice in financial literacy that is specific to women.

According to a study done by Bank of America, women feel less inclined to invest and are more apt to save.

According to Dunlap, 90% of articles and how-tos aimed at women regarding money are in fact centered around saving. In contrast, the advice men receive is centered around investing and building wealth. The way to build wealth is making strategic, long term financial decisions that will benefit in 30 plus years. Additionally, it is addressed that there is a gap in the education of financial literacy between women and those of marginalized groups.

However, some feel blessed just to have a job because of lack of education, and feel they cannot ask for more. Therefore, they feel they should work harder to prove themselves. Employers can take advantage of this: perpetuating the cycle of low wages and the continuation of exploiting women and marginalized groups.

Companies ask you not to discuss wages, because they would have to answer why some are paid more. Speaking to others about salaries is important, as it holds companies accountable to have fair wages between all employees. Dunlap is passionate about educating everyone on how to become financially stable, leading to less feelings of shame about asking for their worth. She provides a script in her book to follow when asking for a raise. Dunlap states “a financial education is a women’s best form of protest.” This can be said for anyone, as the best form of protest against a system that seems to be taking advantage of those with less knowledge is to gain that knowledge.

In “Financial Feminist,” there are different aspects of how to invest and what savings accounts we should be considering: such as, a HYSA (High yielding savings account) and how to pick a 401K. Dunlap guides readers through what debt to pay off first and how to do it. Yes, certain debt should be paid first before others.

Dunlap helps her consumers build their knowledge for financial growth in easy, digestible steps. The best part, it comes shame free and with less restrictions. Furthermore, most of us do not respond well to restriction, as it makes us want it even more.

Dunlap begins with the emotions around money; what our first memory is of money. She goes on to explain that this can shape our entire relationship with money and why we interact with it the way we do. If you grew up with a parent who told you every three months that you may lose your home, you may become overly frugal and frightened to lose money.

Throughout the book, homework is given at the end of each chapter. It is important to be mindful with our money and the homework helps with just that. Working through the narratives within your thoughts about money, either positive or negative. Her belief is that she wants you to grow into a healthy relationship with money.

An important chapter regards budgeting, which Dunlap manufactured her own system for. Her system allows one to enjoy their life while still saving and paying off debt.

“I don’t believe in deprivation in any sense of the word, and there is a reason I created my own budgeting system, because none of the rest of them worked very well,” stated Dunlap.

Reading “Financial Feminist” is enlightening and a healthy dose of financial reality. Although the book is available on audiobook platforms, it is recommended to have a hard copy. Dunlap provides the homework that is required to guide the reader to better comprehend what she is teaching. With her advice and homework, it forces the reader to address their financial shortcomings.

Dunlap’s book is a must for anyone who is curious on how to build their financial future. There is no doubt that she has most of the answers, with a published book, world known podcast and a huge following on her social media. “Financial Feminist” can guide anyone to a better financial future.